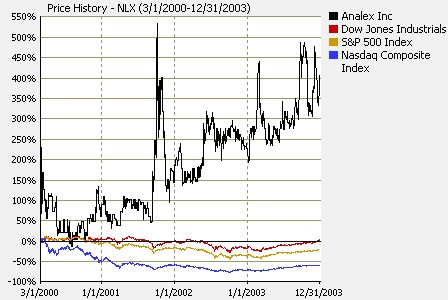

ANALEX specializes in developing intelligence, systems engineering and biodefense solutions in support of our nation’s security. Analex focuses on developing innovative technical solutions for the intelligence community, analyzing and supporting defense systems, designing, developing and testing aerospace systems and developing medical defenses and treatments for infectious agents used in biological warfare and terrorism. In Fiscal Year 2000 the company lost $745,000 on $19.9 million in revenue. In 2003 the company generated over $4.2 Million in EBIDTA on $66.1 Million in revenue. Hadron, Inc./Analex Corporation Timeline.

March 30, 2000

HADRON, INC. (OTC BB: HDRN) today announced that it has received $877,500 in equity capital from a group of investors led by Jon M. Stout, who has been named to the position of President and Chief Executive Officer. The investment group, which also included investment banker J. Richard Knop and John D. Sanders, financial advisor and a member of the Company’s Board of Directors, purchased 2,250,000 units, each consisting of one share of common stock and a warrant to purchase 0.9 shares of common stock, at $0.39 per unit. The five-year warrants are exercisable at $0.72 per share.

September 18, 2000

HADRON, INC. (OTC BB: HDRN) today announced financial results for its fiscal year 2000 fourth quarter, ended June 30, 2000. The Company reported operating income of $262,000 and net income of $204,000 ($0.03 net income per share) versus an operating loss of $179,000 and a net loss of $156,000 (an $0.08 net loss per share) for the fourth quarter of fiscal 1999. Hadron’s earnings before interest, taxes, depreciation and amortization (EBITDA) for the fourth quarter were $404,000. The Company’s profitability was achieved through a combination of controlling overhead costs while increasing the productivity of the Company’s technical and professional staff.

For the fiscal year ended June 30, 2000, Hadron reported revenues of $19.9 million, an operating loss of $421,000 and a net loss of $745,000 (a $0.23 net loss per share) versus revenues of $20.3 million, operating income of $63,000 and net income of $34,000 ($0.01 net income per share) for the prior fiscal year. The Company’s operating and net losses incurred during the first three quarters of fiscal year 2000 resulted primarily from loss of billable staff due to the hiring of certain of the Company’s technical employees by a major customer; goodwill amortization and interest expenses associated with acquisitions; and investments in new business initiatives in the area of biological weapons defense. The Company’s EBITDA for the fiscal year ended June 30, 2000 was $58,000.

November 15, 2000

HADRON, INC. (OTC BB: HDRN) today announced the financial results for the first quarter of its fiscal year 2001, ended September 30, 2000. The Company reported an operating profit of $136,000 and net income of $63,000 ($0.01 net income per share) versus an operating loss of $358,000 and a net loss of $451,000 (an $0.18 net loss per share) for the first quarter of fiscal 2000. Hadron’s earnings before interest, taxes, depreciation and amortization (EBITDA) for the first quarter were $246,000. The Company’s profitability was achieved through aggressive cost reductions combined with increased productivity of the Company’s technical and professional staff.

November 1, 2001

HADRON, INC. (OTC BB: HDRN) today announced it has signed an agreement to acquire Analex Corporation, a provider of high-tech professional services principally to the U.S. government. Founded in 1981, Analex is a privately held engineering and program management firm whose principal customers are NASA and the U.S. intelligence community. Analex has won numerous awards for the design, development, analysis, and testing of products and systems for the aerospace, information technology, high-tech manufacturing, telecommunications, and medical industries. Analex has more than 300 employees and offices in Cleveland, Ohio; Denver, Colorado; Phoenix, Arizona; and at Kennedy Space Center in Florida. Analex’s 2000 revenues exceeded $25 million. The consolidated company will have 450 employees and 2001 revenues of approximately $45 million.

Consideration for the transaction consisted of $6.5 million in cash, 3.6 million shares of Hadron restricted common stock and assumption of certain debts. To finance the transaction, Hadron negotiated a new senior credit facility with Bank of America and concluded a private equity placement. The transaction is expected to be finalized within two weeks.

April 29, 2002

HADRON, INC. (OTC Electronic Bulletin Board: HDRN) today announced a substantial earnings increase for the first quarter of 2002, ended March 31, 2002. The Company reported net income of $395,200 ($0.02 per share) and operating income of $688,500 compared to net income of $21,300 ($0.00 per share) and operating income of $83,700 for the quarter ended March 31, 2001. Hadron’s earnings before interest, taxes, depreciation and amortization (EBITDA) for the first quarter were $783,800 compared to $201,200 for the previous year’s first quarter. The Company’s profitability was achieved primarily through a combination of acquisition, internally generated growth in profits and strong control of overhead costs.

For the first quarter of 2002, Hadron reported revenues of $13 million, compared to revenues of $4.2 million for the comparable period of the prior year. The increase is primarily due to revenues of $8.3 million generated by the Company’s Aerospace Group, formerly Analex Corporation, combined with increased revenues from biodefense contracts.

May 29, 2002

HADRON, INC. (OTC BB: HDRN) today announced that its wholly-owned subsidiary, Analex Corporation, has been awarded the Expendable Launch Vehicle Integrated Support (ELVIS) contract by The National Aeronautics and Space Administration (NASA). The total value of the ELVIS contract is $163.7 million over a period of nine years and four months. The ELVIS contract award is expected to increase Hadron’s employee base to more than 550, and increase the Company’s revenues by more than $17 million per year over the course of the contract. Other members of Analex Corporation’s ELVIS team are SAIC, Swales Engineering and a.i. solutions.

Under the ELVIS contract, Analex will provide a broad range of Expendable Launch Vehicle (ELV) support services for NASA requirements at John F. Kennedy Space Center, Florida; Cape Canaveral Air Force Station, Florida; Vandenberg Air Force Base, California; and other launch site locations. This includes management, operation and maintenance of facilities, systems and equipment, as well as specified technical and administrative capabilities.

Hadron’s shareholders recently approved changing the Company’s name to Analex Corporation, a name that has broader recognition in the Company’s key markets. This name change will occur during the third quarter of 2002. Hadron acquired Analex Corporation in November 2001.

February 19, 2003

ANALEX CORPORATION (OTC Electronic Bulletin Board: ANLX) today announced that its common stock has been approved for trading on the American Stock Exchange (Amex). The stock is expected to start trading on the Amex in early March 2003.

April 22, 2003

ANALEX CORPORATION (Amex: NLX) today reported first quarter 2003 revenue of $16.6 million, a 28% increase over the prior year. For the quarter ended March 31, 2003, Analex’s net income of $735,400 represents an 86% increase compared to the prior year. The growth in revenue resulted primarily from the company’s Expendable Launch Vehicle Integrated Support (ELVIS) contract with NASA and the general growth of revenues in its Homeland Security Group.

Operating profit for the first quarter as measured by earnings before interest and taxes (EBIT), was $1.1 million, an increase of more than 69% over 2002 first quarter EBIT of $673,100. This represents EBIT margins of 6.9% compared to 5.2% a year earlier. The EBIT increases were attributable to increased operating margins at each of Analex’s three operating units. Earnings before interest, taxes, depreciation, and amortization (EBITDA) rose 65%, from $768,000 in first quarter 2002 to $1.3 million this year, with EBITDA margins rising from 5.9% to 7.6%.

First quarter 2003 net income of $735,400 increased 86% compared to $395,200 reported for the first quarter of the prior year. The company’s net margin increased from 3.0% in the first quarter of 2002 to 4.4% this year. Earnings per share (EPS) for first quarter 2003 were $0.04 based on approximately 17.1 million fully-diluted shares outstanding compared to $0.02 per share for the first quarter last year, an increase of 100%. The improvement in net income resulted from the increase in operating profit and a reduction in interest expense, offset by an increased provision for income taxes.

December 9, 2003

ANALEX CORPORATION (Amex: NLX) today announced that its stockholders approved a $25 million investment by Pequot Ventures, the private equity arm of Pequot Capital Management, Inc., and also voted to approve an amendment to the Company’s certificate of incorporation to increase its authorized capital stock.

As previously announced and described in the Company’s proxy materials, Pequot purchased $15 million of convertible preferred stock, the proceeds of which are intended to provide Analex with funds to support future acquisitions, as well as $10 million aggregate principal amount of convertible secured subordinated promissory notes from Analex, the proceeds of which were used by Analex primarily to repurchase the equity holdings of Analex Chairman Jon Stout, his family members, and certain entities controlled by Mr. Stout and his family.

February 26, 2004

ANALEX CORPORATION (Amex: NLX) today reported full year 2003 revenue of $66.1 million, an 11.5% increase over 2002 revenue of $59.3 million. Operating income, or earnings before interest and taxes (EBIT), increased 1.8% over 2002, while earnings before interest, taxes, depreciation, and amortization (EBITDA) increased by 5.4%, from $3.9 million to $4.2 million in 2003. Net income rose by 16.5% to $ 2.7 million in 2003.